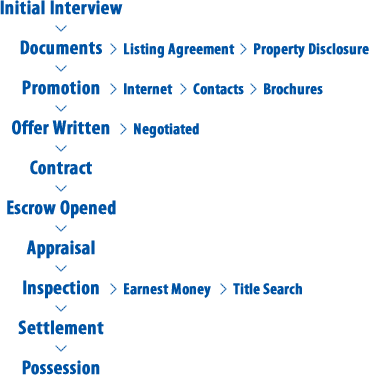

Process of Buying A Home

Orientation

During the initial interview, youll share your expectations and learn about the process of buying a home. Youll obtain valuable market knowledge about areas, prices, financing, your qualifications, and normal procedures.

Considering your wants, abilities, and needs, you deicide on price, size, style, and area. At this point, we will begin the search to find your new home.

Financing

A strategy for a successful purchase is to apply for pre-approval prior to finding a home. Negotiating a contract with a loan commitment can be advantageous to you.

There are specific things necessary to make a loan application and assembling them can take some time. It is recommended to use the enclosed list.

Formulating an Offer

When you find the right home, you will want to make an offer to purchase it. This is done in writing specifying every detail that is part of the agreement. There are standard forms that your real estate agent can provide you.

The last step is to assemble all of the loan papers at the settlement. You will need to pay the balance of your down payment and your closing costs at this time. Usually, a cashiers check is required for these funds.